How to Open a Trading Account in Canada 📝

Thinking about buying your first ETF or stock? Nice. Below is a clean, step-by-step guide to open a self-directed account at Wealthsimple and Questrade—two of the most popular choices for Canadian DIY investors.

Hey everyone! This time, I am writing a how-to guide. I hope you find it easy to follow.

In short ... 💸

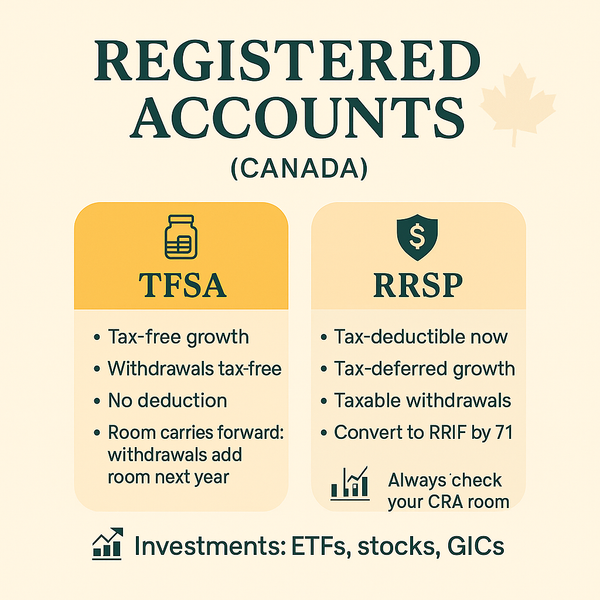

- Decide your account type (TFSA, RRSP, FHSA, or Non-Registered).

- Gather your ID, SIN, address, and banking details.

- Open your account online (5–15 minutes).

- Link your bank and fund the account.

- Turn on 2-factor authentication, set dividend reinvestment/DRIP if you want, and complete tax forms (e.g., W-8BEN for U.S. securities).

What you’ll need (for both brokers) 🪪

- Government photo ID (driver’s licence or passport)

- SIN (CRA requires it for investment accounts)

- Home address & employment info

- Bank details (void cheque/online banking to link accounts)

- A few minutes to answer risk profile questions

Tip: Decide the account type before you start.TFSA: tax-free growth and withdrawals.RRSP: tax deduction now, tax later.FHSA: tax-advantaged for first home.Non-registered: fully taxable, but no contribution limits.

Open a Wealthsimple trading account (step-by-step) 🏦

- Create your profile

- Use my referral link to earn a $25 bonus for both of us, or download the Wealthsimple app (or use the desktop version) and sign up using your email + a strong password.

- Verify your email or phone and enable two-factor authentication.

- Start an application

- Choose Self-Directed (Wealthsimple’s DIY trading).

- Pick your account type (TFSA, RRSP, FHSA, Personal/Non-registered, etc.).

- Enter personal info, SIN, and employment details.

- Verify your identity

- Upload photos of your ID and a quick selfie if prompted.

- Link your bank & fund

- Connect your chequing account and move cash via EFT; you can also transfer assets from another institution (in-kind or in-cash).

- Optional: set up automatic contributions.

- Account settings to finish

- Complete the W-8BEN form if you’ll buy U.S.-listed securities (reduces U.S. withholding).

- Turn on DRIP (dividend reinvestment) if desired.

- If you hold U.S. securities, consider opening a USD sub-account (if available to you) to avoid repeated FX conversions.

You’re set—search your ETF/ticker, preview the order, and place a small first trade to get comfortable.

Open a Questrade self-directed account (step-by-step) 🏦

- Start online

- Use my referral link to earn a $50 bonus for both of us, or visit Questrade and select Self-Directed Investing (not Questwealth Portfolios/robo, unless you want that).

- Create your login, verify your email, and enable 2-factor authentication.

- Choose your account(s)

- Pick TFSA, RRSP, FHSA, Margin/Non-registered, RESP, etc.

- Fill in personal info, SIN, investment objectives, and experience.

- Identity check

- Upload ID and complete KYC questions.

- E-sign account agreements.

- Fund your account

- Link your bank for EFT, use online bill payment, wire, or request an account transfer from another broker (in-kind to move existing holdings, or in-cash).

- You can set pre-authorized deposits to automate contributions.

- Finalize settings

- Complete W-8BEN for U.S. securities.

- Enable DRIP per account if you want distributions reinvested.

- Create watchlists and learn the order ticket (limit, market, time-in-force).

Place a tiny test order (e.g., one share) to practice submitting, modifying, and cancelling orders.

Moving money or accounts (either broker) 💵

- Bank transfers (EFT): Simple for new cash.

- Transfer from another brokerage: Use the broker’s “Transfer account” workflow. Choose in-kind to move existing ETFs/stocks without selling, or in-cash to transfer cash only.

- Timelines & fees: Your new broker usually covers transfer-out fees up to a cap—check their current policy before you initiate.

Quick comparison: which should you pick? 📊

- Wealthsimple: Streamlined app experience, very quick onboarding, simple order ticket; good for set-and-forget index investors who value ease.

- Questrade: Feature-rich for DIY investors (research tools, order types, multiple platforms); popular if you want more control as you advance.

You can also use both—e.g., keep your TFSA at Wealthsimple for simplicity and your RRSP at Questrade for advanced features.

Pro tips before your first trade

- Start small while you learn the interface.

- Prefer limit orders for predictable pricing.

- Double-check you’re in the right account type before placing each order.

- Keep a simple notes doc: what you bought, why, and when you’ll review.

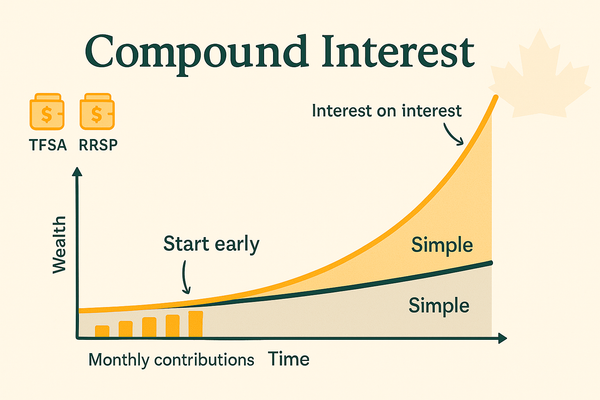

- Revisit contributions monthly or on payday—habits compound.

- Always keep an emergency fund outside your investment account.

Friendly reminder 🎗️

This is education, not individualized advice. Account flows and policies change; Please review each broker’s latest terms, especially for fees, FX, and transfer policies.